owner draw vs retained earnings

So if I understand correctly your contributiondrawing is negative. In other words retained earnings are.

Retained earnings are profits or earnings of the business that have been kept for business use and not distributed to the owners or stockholders.

. The owners dont pay taxes on the amounts they take out of their owners equity accounts. What is an owners draw. Heres a high-level look at the difference between a salary and an owners draw or simply a draw.

When they take a draw for their personal uses they use cash reserves. The draw method and the salary method. With the draw method you can draw money from your.

A draw lowers the owners equity in the business. Owners draws can be scheduled at regular intervals or taken only. An owners draw also called a draw is when a business owner takes funds out of their business for personal use.

If you are generating profits which I assume you are in order to continue taking draws then your retained. Benefits To Being On Payroll. Owners Equity Vs Retained Earnings And Business Taxes.

On the other hand retained earnings represents the accumulated profits and losses of the entity. The rules governing Limited Liability Companies vary depending on the state so be. Business owners might use a draw.

Owners equity refers to what youve invested in the company whether thats your own personal money or your time. Opening Balance Equity This account gets posted to when you create a new chart of account for a loan or item that you enter a opening balance for in the set up of the account. In other words earnings are divided and taxed accordingly.

All business types except corporations pay taxes on the net income from the business as calculated on their business tax return. Owners equity is made up of different funds including money youve invested into your business. Owners Draw vs Salary.

Taxes on owners draw in an LLC. An owners draw also known as a draw is when the business owner takes money out of the business for personal use. However this draw should not.

The business would record. Unlike corporations partners pay tax on the partnership earnings regardless of whether they were distributed or. Salary method vs.

A corporation pays tax on annual net income profits minus deductions credits etc not retained earn. An owner of a sole. If you pay yourself a salary like any other employee all federal state Social Security and Medicare taxes will be automatically taken out of your paycheck.

It can decrease if the owner takes money out of the business by taking a draw for example. Theres a value to owners equity and its an asset. The business owner takes funds out of the business for.

As for Owner Equity open the chart of accounts and try to open each Equity account. Often directors and owners draw more funds than accumulated retained earnings hence the equity. There are two main ways to pay yourself.

The one that does NOT have a Register view no matter what it is named is Retained. It means owners can draw out of profits or retained earnings of a business. The owners draw or distribution account is a contra-liability account that reduces equity.

An owners draw is an amount of money an owner takes out of a business usually by writing a check. It creates a negative drawings impact on the business. Owners draws are usually taken from your owners equity account.

Owners Draws 50000 Total Closing Owners Equity.

Owners Equity Net Worth And Balance Sheet Book Value Explained

How To Calculate Retained Earnings Formula Example And More

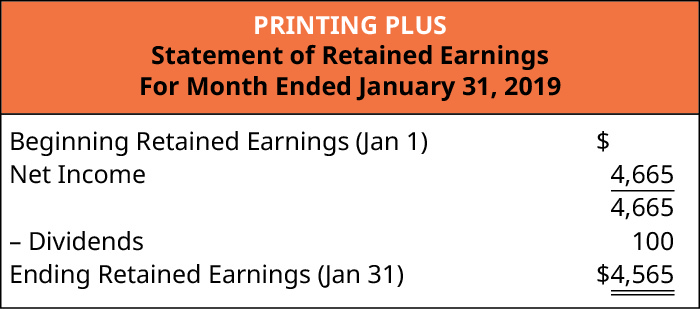

Statement Of Retained Earnings Definition Formula Example Video Lesson Transcript Study Com

/Clipboard02-5c6ecfab46e0fb0001b6815b.jpg)

Expanded Accounting Equation Definition

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Financial Accounting

Understanding Retained Earnings In Quickbooks Youtube

Quickbooks Owner Draws Contributions Chart Of Accounts Quickbooks Accounting

Accumulated Other Comprehensive Income And Treasury Stock Accountingcoach

/EAE-e75afd7778c6484da673c69f0fdfbb55.png)

Expanded Accounting Equation Definition

Retained Earnings Account Is Missing

Retained Earnings Account Is Missing

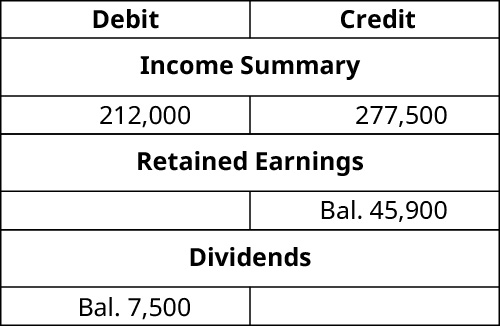

Describe And Prepare Closing Entries For A Business Principles Of Accounting Volume 1 Financial Accounting

T Account For Retained Earnings Youtube

Debit And Credit Chart Accounting Career Accounting Accounting And Finance

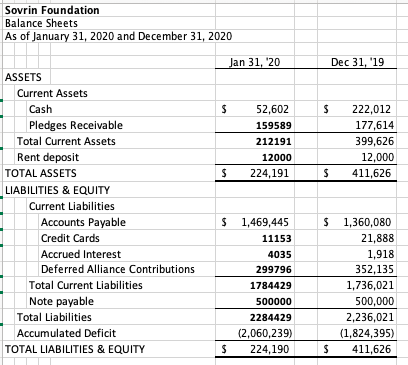

Negative Retained Earnings Accounting Services

Statement Of Retained Earnings Definition Formula Example Video Lesson Transcript Study Com

:max_bytes(150000):strip_icc()/BOA-f8957c5ee9c14788b59a7e5edd802a7b.jpg)